Large Call to Action Headline

Market Volatility?

Secure Your Retirement with a

INDEX ANNUITY

Leverage your old 401(k)s, CDs, or inheritance to create

guaranteed income for life.

Turn uncertainty into security with a Personal Pension Plan.

Uncertainty is the New Normal Your Retirement Plan Needs Guarantees

Between tariffs, inflation, and global instability, market-based retirement strategies are riskier than ever. If you're within 5–10 years of retirement, there's little room for error.

Index Annuities offer guarantees other investments can't:

No market loss due to volatility

Locked-in growth from market index performance (without downside risk)

Guaranteed income you can't outlive

Reposition stagnant or exposed assets like:

Old 401(k) plans

Certificates of Deposit (CDs)

Lump-sum Inheritances

Traditional IRA funds

Underperforming Mutual Funds

Savings accounts earning low interest

HOW DOES FIXED INDEX ANNUITIES WORK

INDEX ANNUITY =

A Personal Pension Plan You Control

Unlike traditional pensions that depend on employer funding, you control how your annuity works

. Whether you're focused on income or asset preservation, we tailor a strategy that fits your retirement needs.

Two Primary Uses of Index Annuities:

Guaranteed Protection & Growth

Ideal for conservative investors seeking growth with principal protection.

Income-Driven

Annuities

Turn your retirement savings into a stream of lifetime income. Never worry about outliving your money.

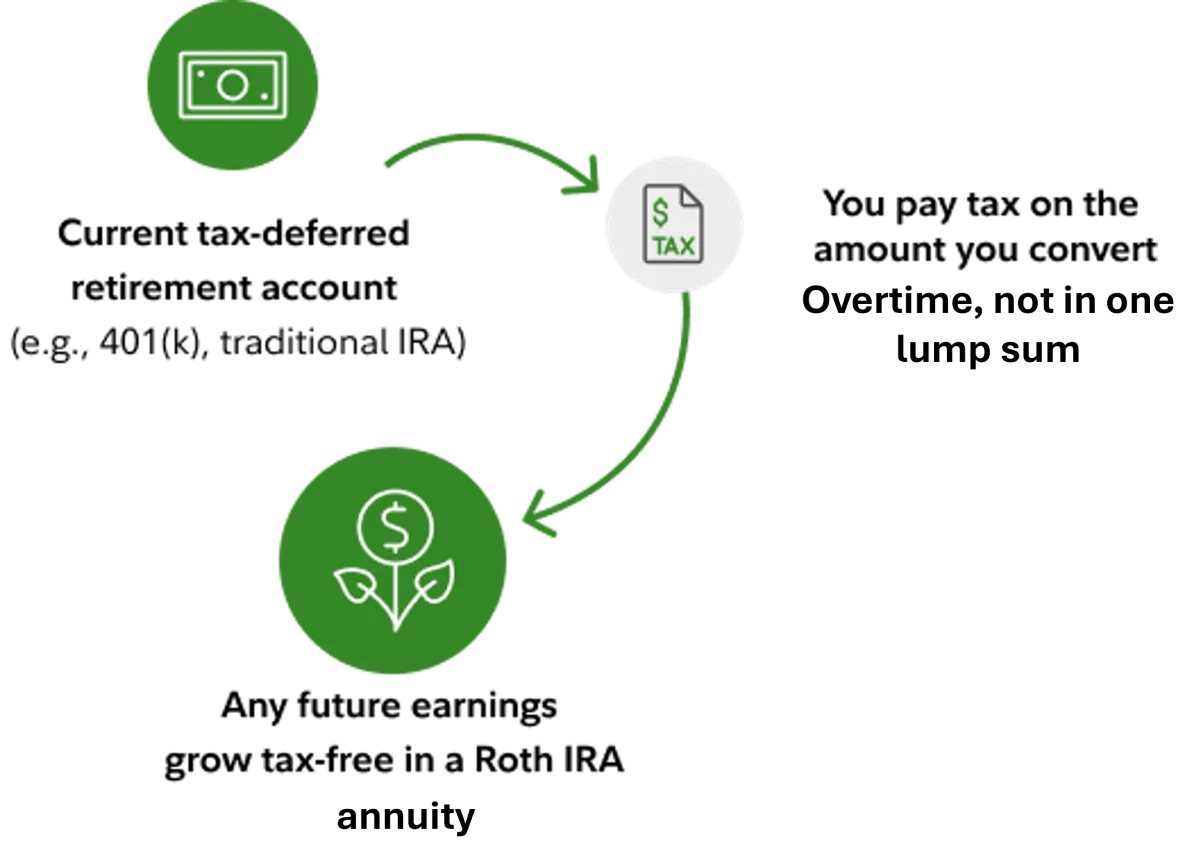

Convert Smart. Pay Less in Taxes.

Index Annuities inside a Traditional IRA can allow piecemeal Roth conversions. This strategy reduces your tax burden by spreading out your conversions over time—rather than getting hit with a large tax bill all at once.

ROTH CONVERSION IN ACTION

BENEFITS INCLUDE

Tax-free income in retirement

Strategic control over your taxable income

More legacy left for your loved ones

TRUSTED ANNUITY PROVIDERS TO WORK WITH

HAVE MORE QUESTIONS?

GET A FREE ILLUSTRATION

The window to act is now. Delaying could mean more risk exposure, more taxes, and fewer guarantees in retirement. Let’s lock in your personal pension plan today.